Packaged foods surged considerably in 2020

Supply and demand is always a factor driving M&A transactions. The COVID-19 pandemic helped certain types of businesses, and those sectors are now targeted acquisitions for smart investors.

The sales of packaged foods surged considerably in 2020 in the U.S. due to the COVID-19 pandemic and lockdown. The retail sales of the products grew with a double-digit growth rate from March to May in 2020.

The U.S. packaged food market size was valued at USD 996.56 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028. Given that the world population is expected to grow to 9 billion by 2050, the packaged food industry will continue to grow.

About registered buyers

Registered Buyers Include:

- Large strategic companies seeking to grow through acquisition

- Family offices

- Private equities

These Buyers Have Gone Through Our Rigorous Vetting Process:

- Financial statements provided showing adequate funds for purchase

- Professional qualifications and/or experience owning similar businesses

- Geographic regions identified for purchase

- Plans for business growth, opportunities for employees, operations, sales and marketing skills explained

Revenue range

Buyer acquisition target criteria range is companies with $5MM-$20MM in revenue.

The minimum EBITDA requirement is $750K – $4MM.

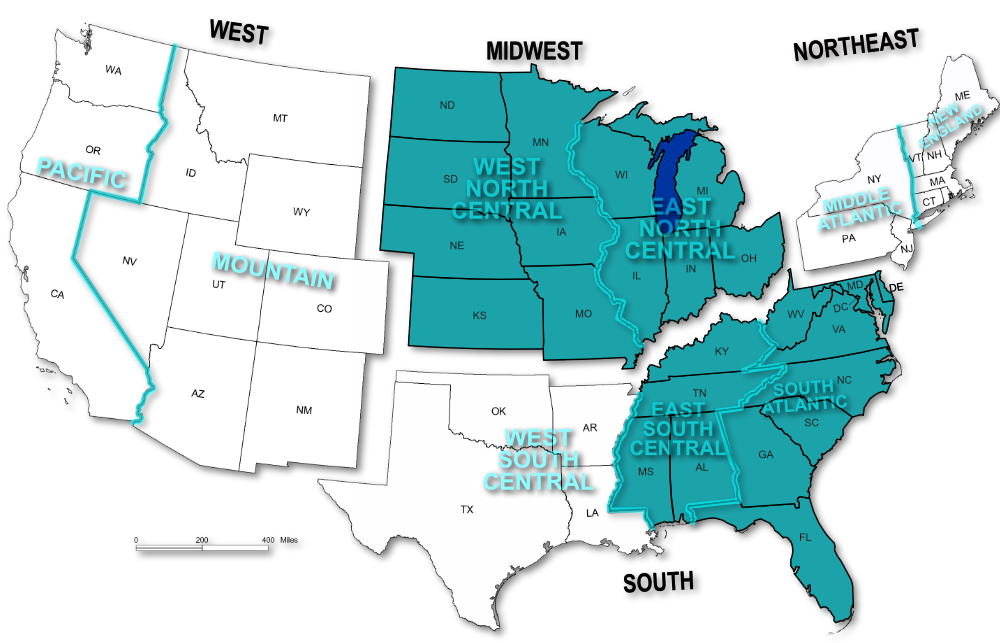

Specific Geographic Interest

Highlighted In Teal

Why Choose Us?

- You never pay money upfront

- We sell over 98% of businesses we list

- We’ve got a 25-year track record selling in the manufacturing sectors

- Consultations are always non-pressure, complimentary, and confidential