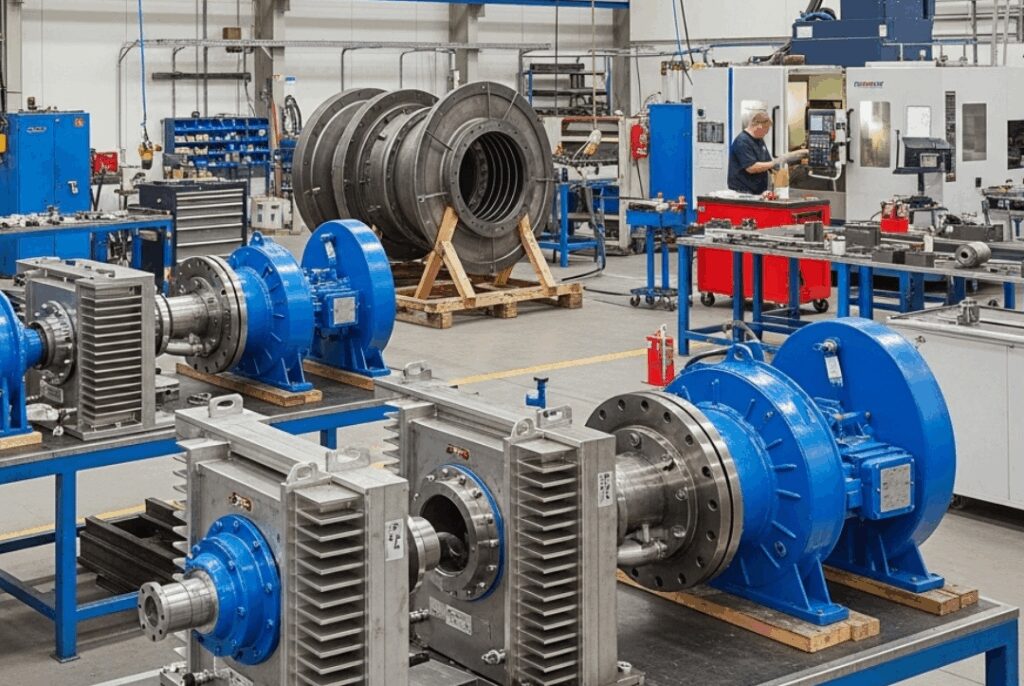

Why U.S.-Made Roots Blowers Beat Imports – And Why This CNC-Capable Manufacturer Is a Standout Acquisition Opportunity

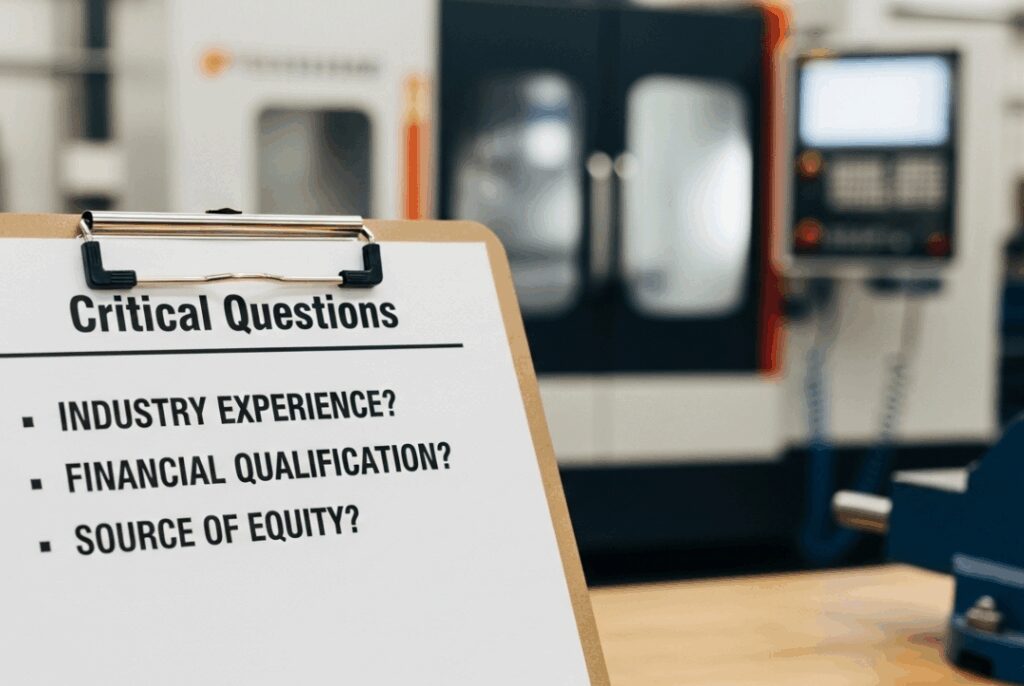

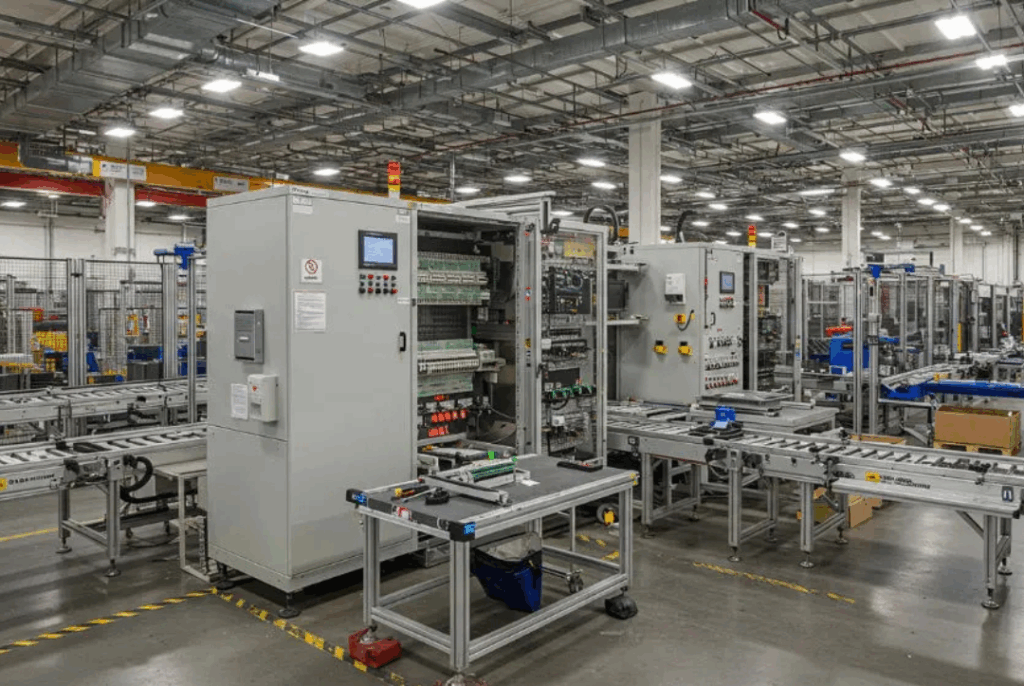

⏱ Reading Time: 5 minutesRoots blowers are becoming a strategic priority for OEMs as they move away from imported equipment due to tariffs, long lead times, and quality risks. This article explains why U.S.-based manufacturing, in-house CNC machining, and application engineering are reshaping buying decisions in industrial markets.