If you’re considering leaving corporate America to become an entrepreneur, you’re not alone. If you have an appropriate down payment and good credit, you’ll likely seek to acquire your way into entrepreneurship. This is a smart move considering you can acquire an established business, customer base and cash flow. Manufacturing in the U.S. is booming and is the most sought-after type of acquisition in the lower middle market. In today’s competitive climate cash flow multiples between 5 – 6x or multiple of Seller’s Discretionary Earnings is appropriate. This figure is validated by the Market Pulse Report. The IBBA and M&A Source present the Market Pulse Survey with the support of the Pepperdine Private Capital Markets Project and the Pepperdine Graziado Business School. A free executive summary of all the recent reports is available at www.IBBA.org.

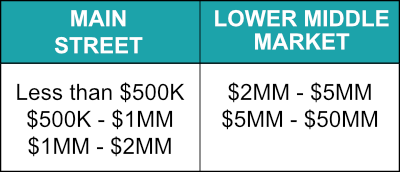

The Market Pulse Report is the pulse of the M&A industry. Its results are more current than any articles found on the web. If you’re in the market to buy a manufacturing company, you’ll likely land on www.BizBuySell.com, which is a multiple listing site for the sale of businesses. The site allows you to search by type of business, price and geographic range. Additionally, the domain hosts advice articles for both Buyers and Sellers. In these articles, you’ll find advice on what cash flow multiples you should pay, which is a direct contradiction to what I’ve advised above. Is BizBuySell.com purposefully inaccurate? No, they are a quality organization, and the largest of their kind in the U.S. The issue is that they are publishing for their core audience, which is main street business Buyers and Sellers. Here’s how the Market Pulse Report defines both “Main Street” businesses and those considered “Lower Middle Market.”

If you spend any time on www.BizBuySell.com, you’ll quickly learn that most businesses promoted on the venue fall into the “Main Street” category. It becomes incredibly challenging to provide advice on cash flow multiples for the acquisition of a company with revenues less than $500K and one with $15MM in revenue, or $5MM for that matter. For instance, in BizBuySell’s “Advice for Buyers” section there is an article on “How to Value A Business.” The article states that most businesses sell at a multiple of 1-3x of SDE. If a qualified buyer attempting to acquire a manufacturing business in today’s market uses this advice to establish his offer, he will lose to his competition. The information in this article is not applicable to most manufacturing companies. Additionally, it shows a 2001-2010 Copyright. Clearly not the most current information. Again, the venue is publishing an article that speaks to their core audience for main street transactions.

All manufacturing companies will not command these cash flow multiples

Some will be higher and some will be lower. Here’s how to spot a great acquisition:

- The business and customer relationships are not heavily reliant on the Seller

- Others in the organization know how to perform any function the Seller does

- The company has standard operating procedures that are well documented

- The company is not operating at full capacity – you’ve got room to grow

- The equipment is up to date and won’t have to be replaced immediately

- There is low customer concentration, (this is unavoidable in some industries like aerospace)

- There’s low hanging fruit for increased sales:

- Improved and enhanced website

- Simple sales and marketing efforts

- Social media presence

Other factors like unique products, materials and proprietary processes play into valuation as well. The bottom line is that there is a wealth of information on the web seeking to inform buyers on what they should pay for a manufacturing business. Make sure that the article you’re trusting is current and is aimed at the size company you’re trying to buy.

Do you have questions? We’ve got answers. Our most common buyer is one who ended a deal in due diligence because of inaccuracies in the data. If you can relate, we understand your pain. There’s a better way and you’ll love the Accelerated Way. You can tell us what you’re looking for in a manufacturing acquisition here.