If you have been dreaming of owning your own business for years, there’s no time like the present to ramp up your search! We previously wrote an article on the “101 Questions You Must Ask Before Buying a Manufacturing Company.” Before you can even ask these questions however, you will need to find the right business!

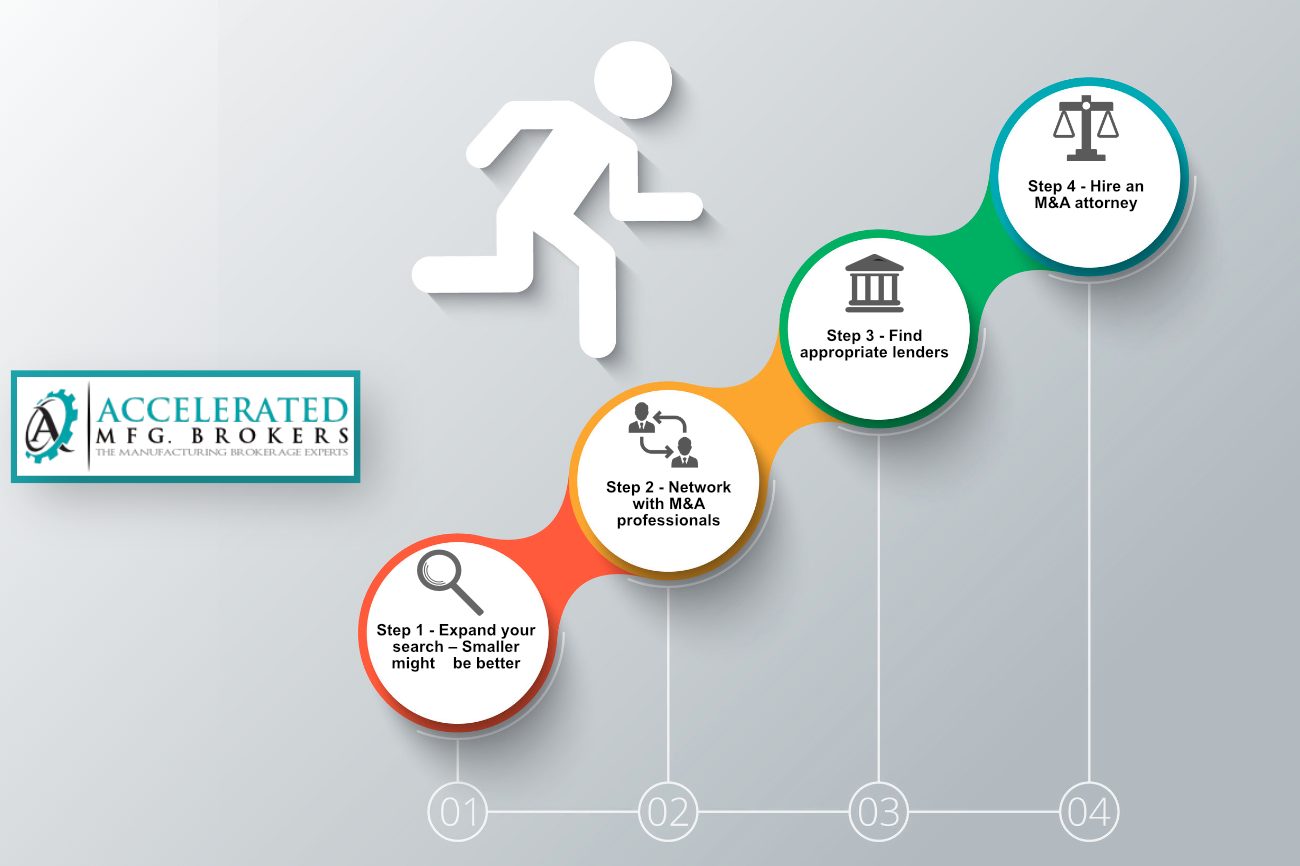

Here are the four critical steps to buying a manufacturing company of your own.

- Expand your search

- Network with M&A Professionals

- Find appropriate lenders

- Hire an M&A attorney

Below we will expand these steps in more detail:

Step 1: Expand your search – Smaller might be better

We receive dozens of identical emails each week saying the following: “I am looking for a business with $2-10 million in EBITDA in a stable industry with an owner wanting to exit.” It seems the entire private equity world is competing for the same thing: $2-10 million in EBITDA and up. Our first piece of advice to those seeking acquisition in 2019 is to expand your search just below this range, even to companies $1 million in EBITDA.

You will be pleasantly surprised to find that there are many quality companies with the same level of leadership, systems, and profitability as larger companies. There is no advantage to buying a manufacturing company running at full capacity—it will take major capital expenditure past the purchase price to grow it any further.

With the right leadership, a $1 million EBITDA business can quickly become one of those in the coveted $2 million EBITDA sweet spot. Open your mind to the possibility of growing into the perfect company, rather than wasting time and money tracking down a rare exact fit.

Step 2: Network with M&A professionals – Be the first to hear about new listings

People are often scared of reaching out to professionals because they do not want to pay excessive fees for services. Engaging in conversation with brokers does not necessarily mean a full-fledged buy-side engagement! Introduce yourself and get your name on their radar—just making a connection may put you in their mind when something comes along.

Different brokerage firms have different processes for interested buyers, so find out how to get yourself qualified and on their Top Buyers list. Reach out, have a conversation, explain your experience and financial qualification, and learn about the process.

It does not hurt to have an M&A professional keeping an eye out for the perfect fit!

Step 3: Find appropriate lenders – Get qualified

Depending on how you intend to fund your acquisition, you will most likely need to engage a bank in the process. It is important to understand what banks look for when granting acquisition loans. Some base a business’s worth on assets and collateral while others have no problem with asset-light companies and will lend based on cash flow.

To give a recent example of this difference, one of our clients took advantage of accelerated depreciation on their machine tools for tax purposes. On the books, their equipment had a value of only $600,000. However, the actual worth of the tools, if they were to be sold at auction, was over $1.6 million. Banks that only look at the tax returns rejected the deal on the basis that there was not enough collateral. Banks that recognized the value of the equipment and had a more entrepreneurial style were happy to do the deal.

You should have conversation with multiple lenders and learn what they are willing to lend on. When you find the perfect business, you will already have contacts with banks of the appropriate lending style.

Step 4: Hire an M&A attorney – An experienced attorney is invaluable

You will need an attorney to help you through this process, and it will be important to hire one that understands how mergers and acquisitions work. A good M&A attorney will save you tons of time, potential issues, and money.

In our recent sale of a New England fabrication shop, the buyer’s and seller‘s legal fees had a large discrepancy—one was nearly DOUBLE the other. The difference? One attorney had M&A experience, while the other did not. The inexperienced attorney took double the amount of work to get the job done and nearly blew up the deal with inappropriate demands. If you're thinking about an acquisition consultant, you may want to read our following article "The Acquisition Consultant Who Destroyed a Buyer’s Dream Acquisition with Bad Advice."

Make sure you are vetting and hiring someone with the know-how to sail through the process—having one on board early will be beneficial when buying a manufacturing company.

Happy searching!