The “Market Pulse Report” is published by Pepperdine University and the Graziadio Business School. The purpose of the report is to track on a quarterly basis the businesses being sold in the United States. The report segregates “Main Street” businesses, (those with revenues between $500K to $2MM) and “Lower Middle Market” businesses, (those with revenues between $2MM – $50MM.)

At Accelerated Manufacturing Brokers, Inc. we deal with manufacturing companies in the lower middle market category. This article discusses highlights from the Q2 2019 Market Pulse Report for that segment of the market.

Tariffs and Trades Wars

Although the report expresses concern around this issue with brokers reporting that some of their clients have been affected by the tariffs, it doesn’t seem to be giving much pause to buyers.

Only 15% of the lower middle market advisors reported that one or more of their business buyers are affected by trade or tariff issues. The number was even lower for smaller businesses.

The report indicates that other than this issue, the M&A market is incredibly strong. The minority of businesses affected by this issue will either wait it out, or lower their price to take advantage of the other positive market conditions.

Hot Industries

Manufacturing companies dominated sales in the $2MM to $5MM range. In the $5MM to $50MM range Engineering/Construction firms boasted the greatest number of sales with manufacturing and health wholesale strong seconds.

Private equity firms drove the growth in engineering/construction firms with rollups in niche specialty markets.

Who’s Buying and What Is Their Motivation?

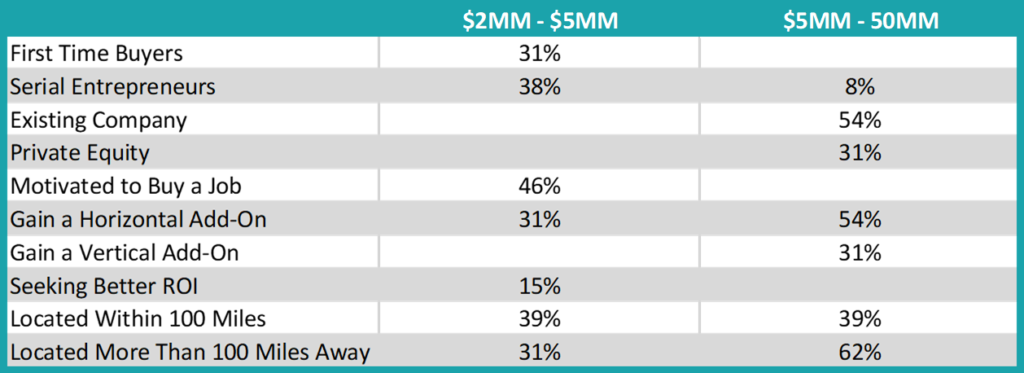

Here’s a look at the types of buyers, what their motivation is and how far they travel to make an acquisition:

For larger manufacturing companies particularly, buyers come from further distances. It’s therefore important when choosing an M&A Advisor to make sure they have a national following.

Who Are the Most Highly Motivated Buyers?

This Market Pulse report explains that Private Equities showed the highest motivation to move deals forward. It’s not surprising that they’re more active than strategics, who are more focused on running their businesses.

Industry reports suggest that private equity has nearly $2.5 trillion in unspent cash right now.

Multiples Remain Strong

In the second quarter of 2019, average sale multiples remained at 5.9 x of EBITDA. This was the same as the first quarter and up from 5.4 x in 4th quarter 2018.

During the second quarter, final sale prices remained at 100% or better of the list price in the lower middle market with 80% of respondents saying they’re still seeing a seller’s market.

Clearly private equities are incredibly active in the current market and are driving prices and multiples upward. The average time from list to close decreased in the second quarter from 12.5 months down to 11 months.

Will the Upward Market Trend Last?

The Exit Planning Institute estimates more than 4.5 million businesses will transition in the next 10 years. Right now, there are more buyers than quality businesses on the market, so Sellers are calling the shots and commanding great prices. This will likely change. As more businesses come on the market, there will be a shift to a buyer’s market.

When exactly that will happen is unclear and the subject of much debate. What is clear from the Q2 Market Pulse Report is that a majority of business owners are not planning far enough in advance for their exit. Is now the right time for you to exit your manufacturing business? Why not learn about the process before you’re in a place where you HAVE to sell.

You can start learning what is involved in the M&A process by registering as a Seller to start the conversation here. There is never a cost or obligation. The more educated you are about the process, the greater likelihood your company will sell at a higher price.

© 2019 Accelerated Manufacturing Brokers, Inc. All Rights Reserved