Considering retirement soon? At the start of 2019 many business owners are examining if this is a good time to put their manufacturing business on the market and head towards retirement. With interest rates rising four times in 2018, it’s wise to look at how this affects the sale of small to mid-size manufacturing companies. In considering this question, one must consider how interest rates affect the Debt Service Coverage Ratio (DSCR) on acquisition loans.

What Is Debt Service Coverage Ratio And How Do Interest Rates Affect It?

DSCR is a measurement used to determine a company’s ability to pay its debt. For the purpose of this discussion, we’re looking at a company’s available cash-flow to pay off an acquisition loan.

Debt Service Coverage Ratio (DSCR) = Business’s Annual Net Operating Income / Business’s Annual Debt Payments

DSCR is used by lenders to determine the likelihood of loan repayment based on the company’s cash flow. The SBA requires a minimum DSCR of 1.15. However, national lenders typically have their own internal requirements which are usually higher, sometimes as high as 1.5.

As Interest Rates Rise The DSCR Decreases

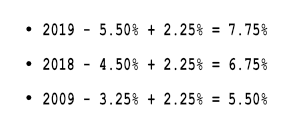

As interest rates rise, this means that acquisition lenders are willing to lend less on the same business, thus acquirers offer less also. Let’s look at some examples. We’ll use an interest rate that is 2.25% above the prime lending rate. So, here’s what that would look like at January 1st for the following years:

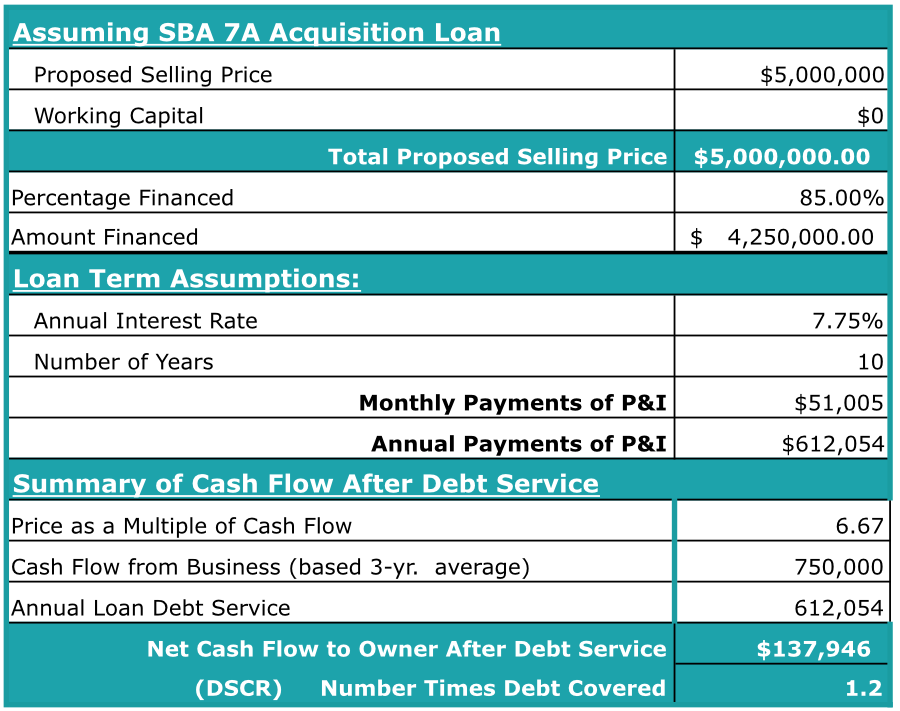

At the 2019 rate of 7.75 the following business has a DSCR of 1.2 and would not meet the internal lending requirements of most quality lenders. It would leave a sum available to the new owner after debt service that would likely not be acceptable for someone who qualified to purchase a $5 million business:

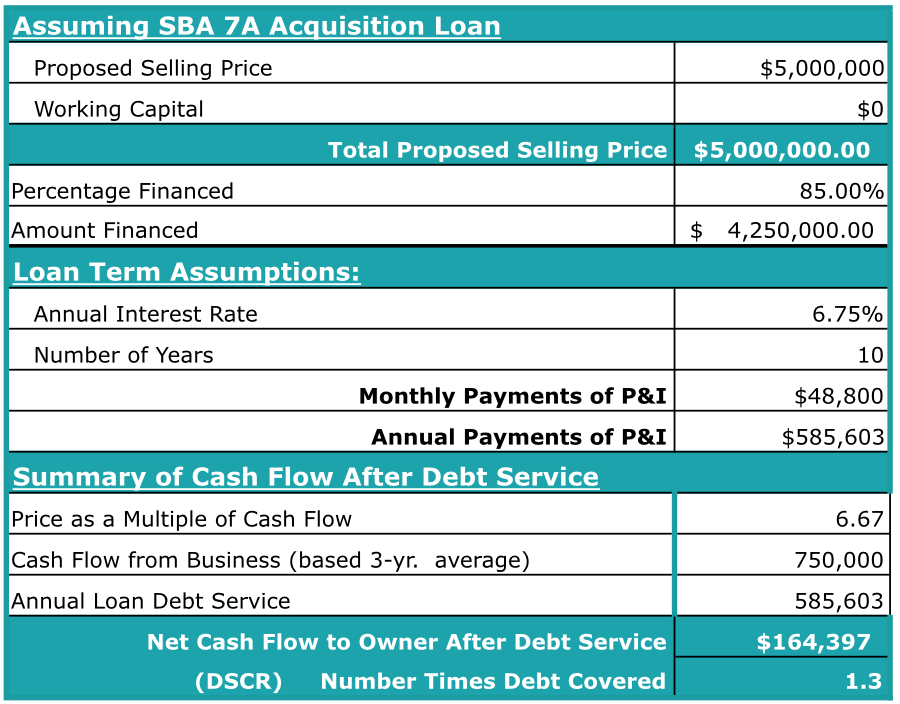

Here’s what the same business would look like one year ago. Notice the net cash flow to owner after debt service is higher. However, this business still would not meet many lender’s requirements:

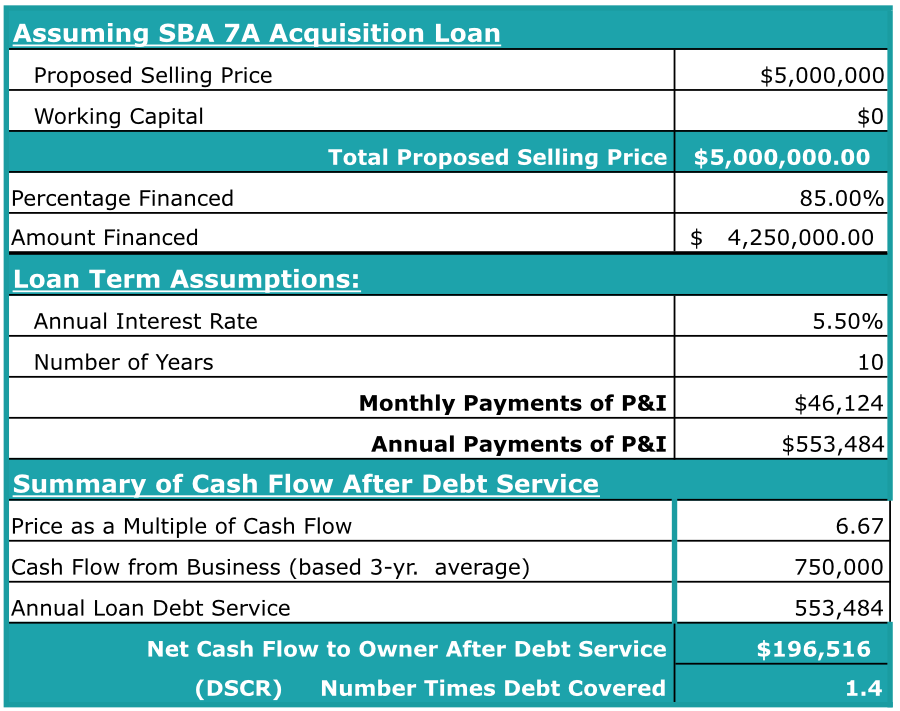

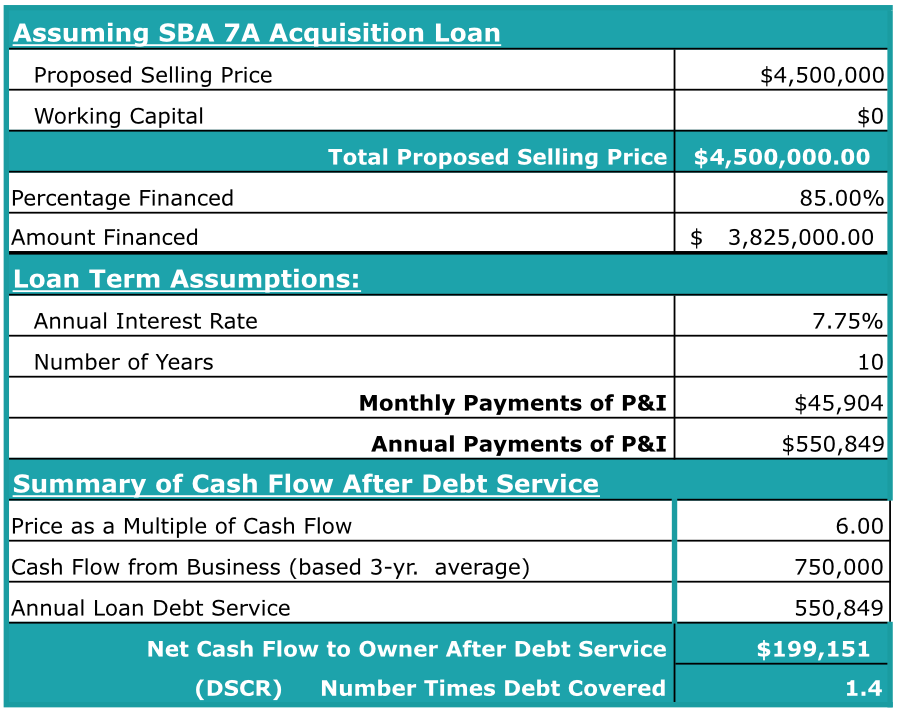

Here’s what the same business looks like with a 5.5% Rate. Notice that the DSCR is now a healthy 1.4, which would be acceptable by almost any lending institution. The remaining cash flow after debt service would be much more attractive to quality buyers.

Now let’s look at how much the purchase price would have to be lowered to maintain a 1.4 DSCR, assuming a 7.75 interest rate. The Seller loses $500K in value, because the increased interest rate affects the DSCR:

In summary rising interest rates affect the sale of small manufacturing companies by:

- Decreasing the Debt Service Coverage Ratio

- Decreasing the available cash flow after debt service

- Decreasing what an acquirer can pay for the business

If you’re thinking about retirement and the sale of your manufacturing company, you may want to consider selling sooner rather than later. Every increase in interest rates makes your business less financeable.

You might be thinking that this is irrelevant because you’ll find an “all cash” buyer. However, those buyers are few and far between. Even when they have the ability to write a check for the business, they don’t want to.

Such was the case with a $4 million manufacturing company we just sold. The buyer had previously been the CEO of a publicly traded manufacturing company with sales in the billions. Although he could pay cash for the business he purchased through us, he chose not to.

Quality buyers typically have their wealth invested in places where they are earning 15-20%. If they can leave their money invested at that level and borrow at 7%, they’re making the spread. This is why they prefer to borrow in order to make a business acquisition.

The bottom line is that interest rates matter and they affect what your business will sell for.

If you have questions or are looking for a retirement plan, contact us by clicking here.