“How much is my manufacturing company worth?”

The frustrating answer is, “It depends.”

But in this guide, we’ll explain common business valuation methods and show you how to value a hypothetical manufacturing company step-by-step. Ideally, you’ll leave understanding how to apply these concepts. In addition to providing a helpful business valuation formula, this guide also covers:

- Methods and techniques — Many valuation approaches exist, but few work for lower-middle market manufacturers.

- Determining your multiple — 15 key factors that can influence your multiple.

- The business valuation in action — Applying the best valuation formula to a hypothetical business.

- Common valuation mistakes — From using the wrong formulas to ignoring tax depreciation opportunities, here’s what to avoid.

This can be a lot to take in. That’s why we’re here. Request a complimentary valuation with our in-house experts.

A valuation method just for lower-middle market manufacturers

There are many strategies for valuating a company. But when it comes to lower-middle market manufacturers, none of those standardized tactics can capture your whole business story. And the valuation method is only the beginning.

At Accelerated Manufacturing Brokers, numerous clients have come to us over the years with initial valuations that completely missed the mark.

That’s what happens when sellers are misled into using the wrong valuation technique.

Bad valuations have devastating impacts for your long-term plans. Selling your business for less than it’s worth doesn’t just leave money on the table, it shrinks your retirement resources. On the other hand, pricing too high stretches the sales timeline, adding unnecessary uncertainty to an already stressful experience.

A bad valuation leaves money on the table

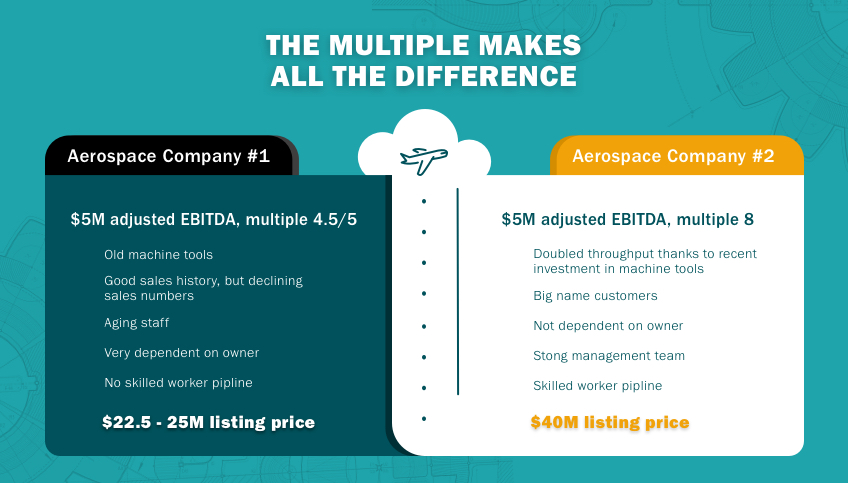

When a metal products manufacturer first reached out to our team for help selling their company, they used a multiplier of 4.5 – 5 by relying on metrics from a popular market report. But our proprietary valuation technique used a multiplier of 8, resulting in an exit deal hundreds of thousands of dollars more than they’d initially expected — and the perfect buyer.

Get an accurate valuation now.

Common business valuation methods

Typically, valuation methods fall into three general categories:

#1 – Market capitalization methods multiply share price by the total number of shares. This is not applicable to lower-middle market manufacturers because it only applies to publicly traded companies.

#2 – Asset-based methods use liquidation or book value. Liquidation counts asset sales profits after paying off liabilities. Book value subtracts total liabilities from total assets via balance sheet statements. For many manufacturers, this can be the most unreliable method because machine tools may depreciate for tax purposes while retaining millions of dollars in literal asset value.

#3 – Income-based methods estimate value based on past, current or projected cash flow and long-term risk. Common methodologies include a simple multiple of:

- EBITDA (earnings before interest, taxes, depreciation and amortization), or

- Seller’s discretionary earnings (SDE), or

- Price to earnings ratio (P/E) ratio, or

- Discounted cash flow projections of future cash flow adjusted for inflation (DCF)

Unfortunately, these formulas only focus on dollars, ignoring the many considerations that affect the overall multiple.

And if you meet someone who thinks a blanket application of these methods can work for your manufacturing company, run.

In our experience, manufacturers are most often misled by a “market method” that determines value by comparing similar businesses.

Investment bankers love the market method, but it fails manufacturers because it doesn’t tell the whole story. For example, alternative meat manufacturers probably received low valuations ten years ago. But now, the demand for alternative protein sources is booming. Forward-looking buyers would value these companies at a much higher number. This is a good example of why the market method doesn’t work: it only looks backwards. Lower-middle market manufacturers need an honest, holistic valuation technique that considers past, present and future trends.

As specialized manufacturing business brokers, we recommend starting with this formula for sellers:

((Net earnings + interest + amortization + taxes + seller salary + seller benefits + depreciation) – (normalized manager salary)) x your unique multiple = business valuation

The keyword in this formula is “multiple.” In our 30 years as specialized manufacturing business brokers, we’ve seen them range from three to 15.

But estimating that number isn’t easy. If you’re just doodling on a bar napkin, here are 15 critical factors to consider when estimating your multiple.

Picking the right multiple for your manufacturing business

Every company is unique. While your company may share similarities with competitors, your individual multiples will differ.

15 questions you must answer to determine your multiple

In our experience, lower-middle market manufacturing companies typically sell at a multiple ranging from three to 10. This list outlines the most common influencers on that number and their impacts. Looking for more detailed information? Read this comprehensive article about manufacturing business multiples.

#1 – How healthy is your company? This comes down to sales, net earnings trajectory and gross margins. For a higher multiplier, you need growing revenue and gross margins above 35 percent.

#2 – Does your company’s success depend on you? When buyers see a company reliant on the seller’s knowledge and expertise, they see risk. To stop this from negatively impacting your multiple, you must reduce this dependence and make yourself available for consultative support after selling.

Raise your multiple by building a dependable management team.

Letting the new owner inherit leadership they can trust means that your exit won’t include the loss of critical institutional knowledge.

#3 – Can you provide at least three years of clean financial data? The last thing a buyer wants is to find out you can’t provide data on the financial metrics of your company. They’ll expect to see your P&L, A/R, AP, balance sheet, sales by customer, length of customer relationships, sales by sector and financial statements. If you can’t provide these, you’re not ready for market. And the better your books, the higher your multiple.

#4 – Is your debt service coverage ratio (DSCR) higher than 1.5x? When potential buyers see a low DSCR, they see red flags. So, ask yourself, do you bring in 1.5x more cash flow than will be required on the debt service of an acquisition loan after an appropriate down payment? Banks won’t risk giving buyers a loan if the cash flow can’t cover the debt. The higher your DSCR, the better.

But this doesn’t just apply to leveraged buyers. When choosing between two $5 million businesses that are identical in every way except cash flow, buyers will choose the one with the higher income, even if they’re not using leverage. And when they’re shopping around, that DSCR is a great indicator of that.

#5 – How concentrated are your customers and sector? To increase your multiple, you’ll generally need diversification of your customer and sector. If more than 15 percent of your revenue comes from any one customer, or 25 percent from any one sector, you’ll likely receive a lower multiple. There are always exceptions —like the aerospace industry, for example — but it’s a good rule of thumb to keep in mind for baseline evaluations.

#6 – Do you have long, stable customer relationships? Stability is worth more on the market. If you have consistent contract renewals and purchase orders throughout the year, your multiple will rise.

#7 – How much competition do you have? It’s an uncomfortable question to answer, but it’s critical for you to face this head on. The plain fact is that companies that are easy to replicate or in industries with low barriers to entry sell at lower multiples.

#8 – Have you invented a proprietary new process, machine or software? Are you a Tier 1 supplier? Do you have coveted contracts with big names in your sector? Patents, unique technologies, industry certifications and prestigious contracts are always a good thing. If you have them, your business will trade at a higher multiple.

#9 – Should buyers worry about new competing technologies? No industry is immune to new technology, but increased vulnerability means a lower multiple.

#10 – How much are your machine tools worth? When buyers need backing from a bank, the value of your equipment is considered because it can serve as collateral for the acquisition loan. But this is not just an acquisition issue. It’s also related to the capital expenditures in addition to the purchase price.

#11 – Will your buyer need to shell out for newer, more reliable equipment? A turnkey business that doesn’t require capital expenditures by the buyer will always sell for a higher multiple.

#12 – Do you have a new talent pipeline? Manufacturing employment has fallen for 40 straight years. If your team includes folks in their prime working age (21-55), your company will trade at a higher multiple.

Raise your multiple through tactical partnerships and apprenticeship programs.

One of our clients built his own future workforce by partnering with his local schools, creating an internship program that ultimately provided a steady supply of knowledgeable new hires.

#13 – Do you have standard operating procedures (SOPs) in place? Success depends on consistency. If employees, new hires and, eventually, a new buyer, have an SOP to reference, transitioning from one owner to the next is seamless. Having successful SOPs in place will increase your multiple.

#14 – Where is your business located? Companies based out of desirable areas with access to skilled labor, health care, good schools and cultural activities will always sell at higher multiples because they are likely to draw multiple buyers.

#15 – Does your facility reflect pride of ownership? In manufacturing, curb appeal is everything. The last thing a prospective buyer wants is a filthy shop with disorganized records and machine chips everywhere. Not only is it an aesthetic turn-off, it hints at deeper issues related to poor maintenance.

Raise your multiple through good housekeeping.

Buyers can tell when you’re faking it. Don’t just last-minute the deep cleaning until the day before prospective buyer tours — implement consistent cleaning practices to keep your facility safe and spotless.

It’s tempting to tally up each of these factors and assume, Hey, my company hits all of these benchmarks! My multiple must be 15.

Unfortunately, selecting a multiple is never that straightforward.

Picking the right multiple is a mix of art, math and expertise. Accurately quantifying each factor’s weight is nearly impossible until an M&A specialist can perform a qualified assessment of your business.

The multiple makes all the difference

How to avoid the biggest and most common valuation mistake people make

More than a dozen factors will almost always influence the final multiple for lower-middle market manufacturers. The top mistake people make when valuing these types of companies is using traditional valuation methods that do not consider intangible aspects of the company like:

- Customers

- History

- Industry reputation

- Difficulty of machining capabilities

- Certifications

- Company culture

- Anticipated sector growth

And many, many more.

Whether it’s an overly simplistic formula, an industry report calculator or an inexperienced investment banker unfamiliar with manufacturing, couching your business valuation in an unreliable tool or person hurts you in the long run.

Every company is unique. Your specific multiple will differ from companies that might appear similar to yours. That’s because quantifying the weight of multiple influencers is nearly impossible until an M&A specialist can dig into your company’s information and perform a qualified assessment.

VIDEO: Maximize your valuation by doing these things right

Nailing your valuation is tough. That’s why you need an expert broker who specializes exclusively in manufacturing. Watch this video to learn more.

How much is your manufacturing business really worth?

Your future is too precious to waste time on bad valuations from brokers who don’t understand your company and your sector.

Accelerated Manufacturing Brokers has been specializing in companies like yours for the past 30 years — and our valuations use 175+ data points. These numbers often come in above initial valuations calculated by DIY sellers, backwards-looking CPAs and investment bankers without manufacturing experience.

But manufacturing experience doesn’t just impact valuation. Working with a broker who specializes in this sector attracts more buyers, thus increasing competition for your acquisition and driving the price upwards — often far above its initial listing price.

That’s an ideal outcome for any exiting business owner.

You’ve spent your life building a dream manufacturing business. Now let us help you manufacture a dream retirement.

Let’s talk: Register as a seller here.