Selling A Manufacturing Business – Why Waiting Will Hurt Your Retirement

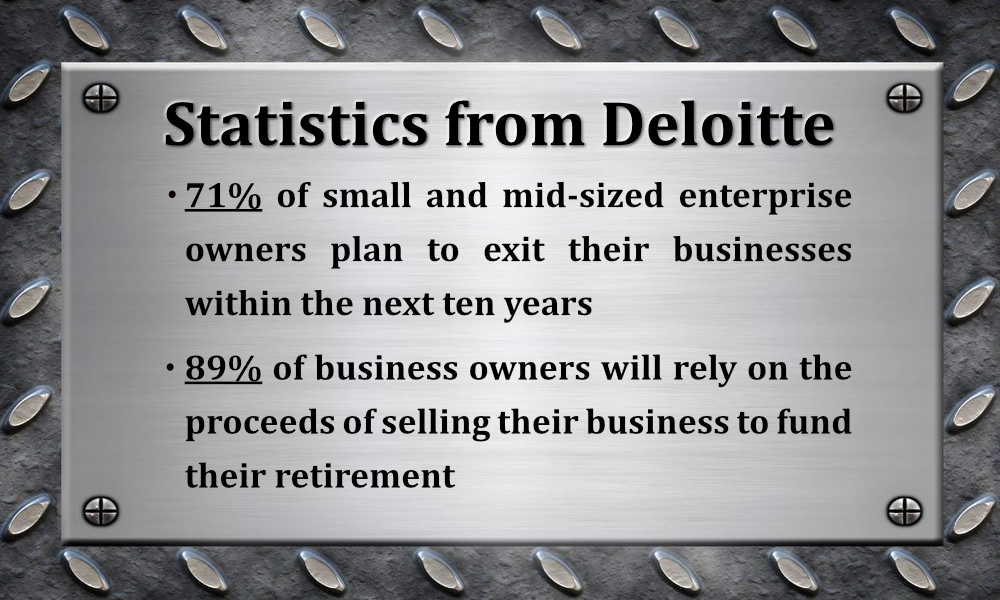

The amount of wealth that baby boomers will transfer by the year 2040 is estimated at $10.4 trillion. With 71% of small to mid-sized business owners making their exit within the next ten years, it is likely that competition for appropriate buyers will be fierce. As the supply of manufacturing businesses on the market surpasses the demand, the prices achieved will certainly decline. In addition to the exiting baby boomers, there are approximately 7,700 companies that are currently owned by private equity groups, that will likely hit the market in the next 5-10 years, adding to the competitive landscape. This will be a problem for the 89% of business owners that plan to rely on the proceeds from the sale of their business to fund their retirement.

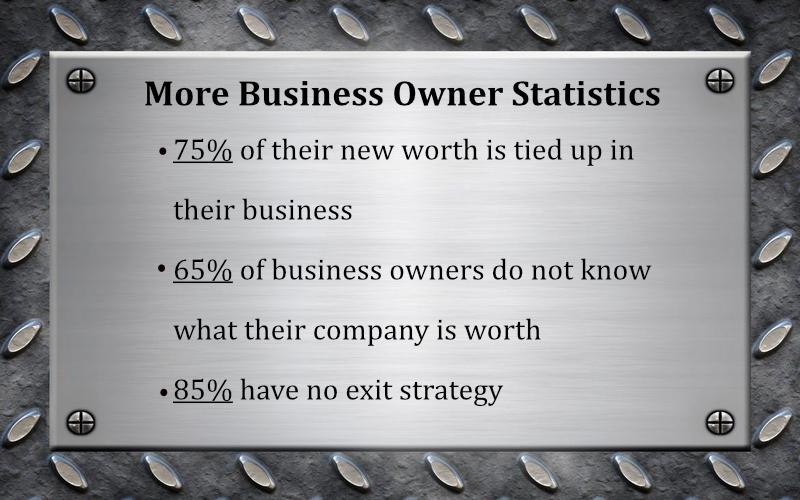

Planning early and preparing your manufacturing business for sale is critical if you want to maximize the value realized from the sale of your business. Here are some statistics that should scare you. Most business owners have 75% of their net worth tied up in their business. More than 65% of business owners have no idea what their company is worth and 85% have no exit strategy.

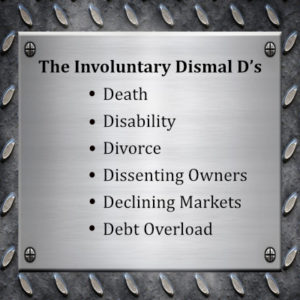

At some point in time, we all exit our businesses, whether voluntary or otherwise. At that time, every owner wants the maximum amount of money for their business in order to achieve their retirement and financial goals. Taking the time to understand your company’s value, the current market conditions, the tax consequences of selling and methods of preparing your company for sale will ensure that you have a choice as to how you exit and help you avoid the dreaded “D’s”

At some point in time, we all exit our businesses, whether voluntary or otherwise. At that time, every owner wants the maximum amount of money for their business in order to achieve their retirement and financial goals. Taking the time to understand your company’s value, the current market conditions, the tax consequences of selling and methods of preparing your company for sale will ensure that you have a choice as to how you exit and help you avoid the dreaded “D’s”

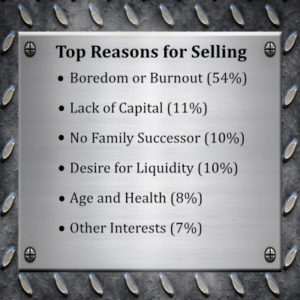

Selling when you’re on top of your game will likely help you maximize value. The statistics on the top reasons for selling a business are very telling as to the percentage of owners that do not PLAN.

It’s clear that those who wait too long to sell may lose value due to an overload of supply and not enough demand. Here’s what you can do NOW to ensure success:

• Work with a manufacturing business intermediary/broker to understand the current value of your business.

• Educate yourself as to what buyers of manufacturing businesses look for when buying.

• Ask your business intermediary/broker to provide suggestions on improving your business BEFORE it goes to market

• Speak with an M&A tax professional to understand the tax implications and most favorable deal structures before putting your business on the market.

Don’t delay! Waiting to take these important steps will hurt your retirement!