In the high-stakes world of lower-middle-market manufacturing M&A, the “F-Reorganization” (or F-Reorg) has become the gold standard for structuring transactions involving S- Corporations. It is often described as a “Swiss Army knife” because it solves multiple problems at once: it provides the tax benefits of an asset sale, the legal simplicity of a stock sale, and a seamless operational transition for customers and employees.

Here’s why an F-reorg is such a powerful tool for both buyers and sellers in manufacturing M&A.

What is an F-Reorganization?

Under Internal Revenue Code Section 368(a)(1)(F), an F-Reorganization is defined as a “mere change in identity, form, or place of organization of one corporation.”

In an M&A context, the process typically involves three steps:

1. The Holding Company Formation: The shareholders of the Target (the “OldCo”) form a new corporation (“NewCo”).

2. The Share Exchange: Shareholders contribute their OldCo stock to NewCo in exchange for NewCo stock.

3. The Conversion: OldCo makes a “Qualified Subchapter S Subsidiary” (QSub) election and then converts into a Limited Liability Company (LLC).

This process transforms the target from a corporation owned by individuals into a disregarded entity (an LLC) owned by a new holding corporation.

1. Operational Continuity: The Power of the EIN

One of the biggest headaches in M&A is the administrative “hairball” of transitioning a business. In a traditional asset sale, the buyer creates a new legal entity with a new Federal Employer Identification Number (EIN). This often triggers a “change of control” or “assignment” clause in every contract.

Maintaining Customer Relationships

Because an F-reorg treats the post-reorganization entity as a continuation of the original business, the company retains its original EIN. This provides massive advantages:

- Contractual Seamlessness: Many customer and vendor contracts are tied to the EIN. By keeping the same ID, the “Target” remains the same legal person in the eyes of many regulators and counterparties. This can bypass the need for tedious “consent to assign” processes that delay closings.

- Payroll & Benefits: There is no need to restart payroll or issue new W-2s mid-year. Employees keep their tenure, and benefit plans (like 401ks) often remain undisturbed.

- Licensing & Permits: For industries like healthcare or construction, where licenses are tied to a specific EIN, an F-reorg avoids the months-long backlog of reapplying for new permits.

2. Tax Advantages for the Buyer

The “Holy Grail” for a buyer in M&A is a step-up in basis.

In a standard stock purchase, the buyer “steps into the shoes” of the seller’s tax basis. If the seller built the business from $0, the buyer has $0 of depreciation to claim. However, an F-reorg allows the buyer to treat the equity purchase as an asset purchase for tax purposes.

- Asset Step-Up: The buyer can “step up” the tax basis of the assets (including goodwill) to the purchase price, creating massive non-cash depreciation deductions that offset future taxable income. This significantly increases the after-tax cash flow of the acquired business.

- QSub Protection: It eliminates the risk of an “invalid S-election.” If the seller accidentally messed up their S-corp status years ago, a traditional 338(h)(10) election could fail. An F-reorg bypasses this risk because the buyer is effectively buying an LLC interest, not stock.

3. Tax Advantages for the Seller

Sellers often fear asset sales because they can trigger higher taxes (ordinary income rates on certain assets). An F-reorg offers a “win-win” bridge.

- Capital Gains Treatment: The seller generally receives capital gains treatment on the sale of the LLC interests, just as they would in a standard stock sale.

- Tax-Deferred Rollover: This is perhaps the greatest advantage for sellers in the lower-middle market. If a seller wants to “roll over” equity (e.g., keep 20% to stay invested with a private equity buyer), an F-reorg allows that 20% to be tax-deferred. In a standard 338(h)(10) election, the seller is often taxed on the entire value of the business, including the portion they didn’t cash out.

- Clean Exit: By selling the interests of an LLC that sits under a NewCo holding company, the seller can often keep “excluded assets” (like a personal vehicle or a specific piece of real estate) up at the holding company level without complicated “carve-out” accounting.

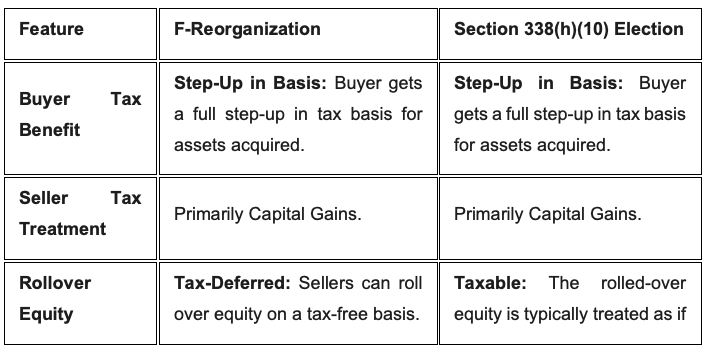

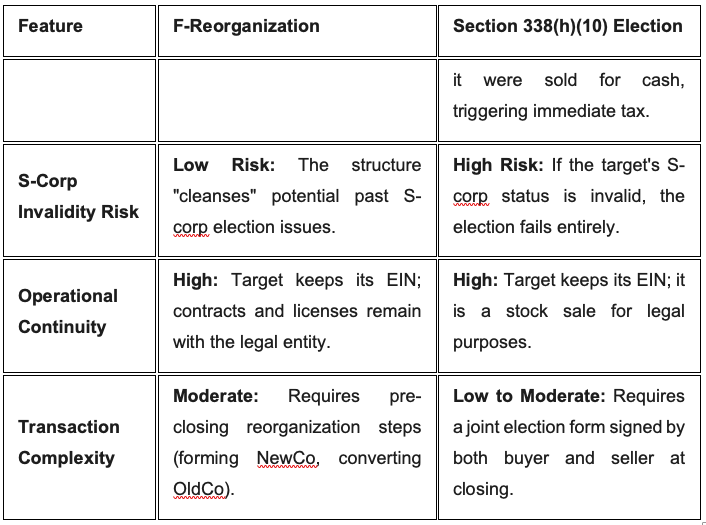

Comparison Table: F-Reorganization vs. Section 338(h)(10) Election

While both structures allow a stock sale to be treated as an asset sale for tax purposes, the F-Reorg has emerged as the preferred choice for many modern transactions due to its flexibility and reduced risk.

Summary of the “Win-Win”

The F-Reorganization effectively splits the atom: it allows the legal side of the deal to look like a stock sale (retaining the EIN and contracts) while allowing the tax side of the deal to look like an asset sale (providing a step-up for the buyer and a tax-deferred rollover for the seller).