Manufacturing Day was established in 2012 to address both the skills gap and misconceptions about modern manufacturing. There is universal agreement this is a valuable and important effort. According to the Bureau of Labor Statistics, more than 500,000 manufacturing jobs remain unfilled month over month, year over year.

The projections are this situation will only get worse. Research by Deloitte and the Manufacturing Institute predicts that over the next ten years, manufacturers will lack 2.4 million of the 4.6 million workers needed.

The Bigger Problem: Manufacturing Owner Founders Are Retiring

Despite the legitimate repackaging of manufacturing work as interesting, honorable, and lucrative, there is an even bigger problem brewing for U.S. manufacturing. About 66 percent of business owners are expected to retire in the next decade.

Attracting young people to the manufacturing sector through Manufacturing Day advocacy each October is a terrific start, however, these new entrants to the manufacturing workforce simply will not be ready to take the helm and manage these companies in time to fill the shoes of retiring manufacturing owners.

The skills gap is far more than a shortage of CNC, lathe, and mold making machine operators and programmers. An entire generation of manufacturing management is lacking; rather than talking about 2.4 million unfilled manufacturing jobs, the urgency will shift to the $454 billion of Manufacturing GDP at risk.

Young Baby-Boomers Saving Manufacturing 2020 and Beyond

For several years there has been a developing phenomenon in Manufacturing Mergers & Acquisitions (M&A). Young baby-boomers are leaving corporate America in favor of buying manufacturing companies.

The Market Pulse Report tracks the M&A industry quarterly; published by Pepperdine University and the Graziadio Business School, the report has shown that manufacturing companies are the most sought-after acquisition in the U.S. (with few quarterly exceptions).

First-time baby-boomer buyers have led the charge in purchasing manufacturing companies, winning the acquisition over private equity and strategic competition. Interestingly, many times these new manufacturing acquirers are from non-manufacturing sectors.

Rationale for Young Baby-Boomers Buying Manufacturing Companies

Professional and educated, the young baby-boomer may have been a victim to corporate downsizing or outsourced by large corporations. There are other specific characteristics which have been identified by Accelerated Manufacturing Brokers, including:

- Baby-boomers want to control their destiny.

- Baby-boomers in acquiring a manufacturing company are buying a job that will nicely fund their retirement in 10-15 years when they sell the company.

- Baby-boomers are tired of current work scenarios that require constant travel or frequent relocation; baby-boomers want to establish roots.

- Baby-boomers’ children have graduated from college and they are turning to focus on what THEY want.

- Baby-boomers often held executive positions in very large, sometimes publicly traded global companies; they have substantial savings and yet feel too young to retire.

Younger Baby-Boomers Are Qualified to Run a Manufacturing Company

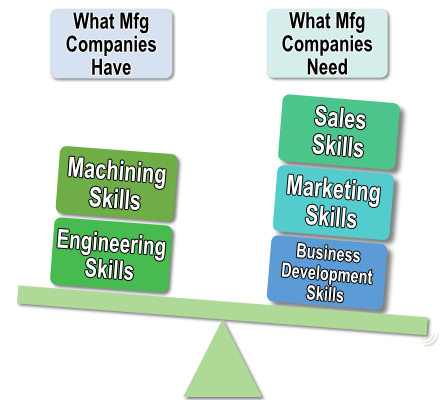

Often younger boomers are not coming out of large manufacturing companies. Management experience is a skillset ideal for running a manufacturing company. The function most often missing in founder-led manufacturing companies is a sales and marketing function. For this reason, young boomers are uniquely qualified.

Common traits of executives buying manufacturing companies in today’s market:

Many of these buyers are coming out of organizations that they helped grow from a few million to a few hundred million in sales. They are highly skilled in the areas of sales, marketing, and business development. Only in very small manufacturing companies, where the business is dependent on the owner for the machining and engineering function, would this skill set not be a suitable match.

For most mid-size organizations a young baby-boomer can take the helm, as well as grow the company beyond the founder’s ability. An additional benefit of having worked for large corporations is the people capital and relationship connections often lacking with the manufacturing founder.

Manufacturers Can Attract the Young Baby-Boomer Buyer

To attract this type of buyer, a manufacturing business owner needs to make sure that the manufacturing side of the business can function without strict oversight. Ensuring that someone other than the owner is customer-facing and can perform quoting (RFQs) and job costing, assuages the concerns of many potential buyers.

Manufacturing Day 2020 and Beyond Can Be Instrumental in Attracting a New Management Force

- When creating shop tours, make sure that events are not merely geared to young future plant floor positions.

- MFG Day must interface and connect with M&A professionals who bring buyers considering manufacturing acquisitions into the process.

- Connect with life coaches who are dealing with those in career transitions.

- MFG DAY promotional material must focus on those with the ability to buy manufacturing companies.

Because manufacturing is where the concept of continuous process improvement (lean manufacturing) started, it is critical that the role and function of MFG Day grow and change with the conditions of the sector.

While a future workforce is critical and must be considered by impressing the culture and opportunities of the sector, attracting the best and brightest to this important sector, must include recruiting and advocating for the future owners of manufacturing firms to take the enterprises to the next level.

Author Profile:

Frances Brunelle is the founder of Accelerated Manufacturing Brokers, Inc., which specializes in the sale of lower middle-market manufacturing companies nationally. Fran and her team help to ensure the continuity of U.S. Manufacturing by transitioning ownership to the next generation of entrepreneur. Fran writes on topics that help manufacturing business owners prepare their companies for sale and navigate the sale process to ensure a positive financial result in support of their retirement.