The electric vehicle market will sky-rocket in the next decade

In 2021 Accelerated Manufacturing Brokers, Inc. sold a harsh environment HVAC manufacturer, which included sales to both commercial and military electric vehicle manufacturers. We’re actively seeking others for current buyers.

This market is hot – and here’s why:

The global electric vehicle market was valued at $162.34 billion in 2019 and is projected to reach $802.81 billion by 2027, registering a CAGR of 22.6%. North America is estimated to reach $194.20 billion by 2027, at a significant CAGR of 27.5%.

When you think of electric vehicles, you might just be thinking of the consumer market. But substantial growth is also expected in other areas. Consider the following recent developments:

- In 2021 the U.S. Postal Service awarded a multi-billion-dollar contract to modernize the postal delivery fleet, including 165,000 new vehicles in the next 10 years.

- In 2020 GM Defense Awarded a $214.3M Contract to Produce the U.S. Army’s Infantry Squad Vehicle.

- As of 2019, there were 645,000 vehicles in the federal government’s fleet; in 2021 President Biden has promised to replace them all with electric vehicles.

- And under current pledges by states, cities and urban transit agencies, at least a third of the nation’s nearly 70,000 public transit buses will be all-electric by 2045

Manufacturers will not be able to keep up with demand. Tier I & II manufacturers in all component areas are already being sought for acquisition.

About registered buyers

Registered Buyers Include:

- Large strategic companies seeking to grow through acquisition

- Smaller component manufacturers seeking expansion through acquisition

- Private equities

These buyers have gone through our rigorous vetting process:

- Financial statements provided showing adequate funds for purchase

- Professional qualifications and/or experience owning similar businesses

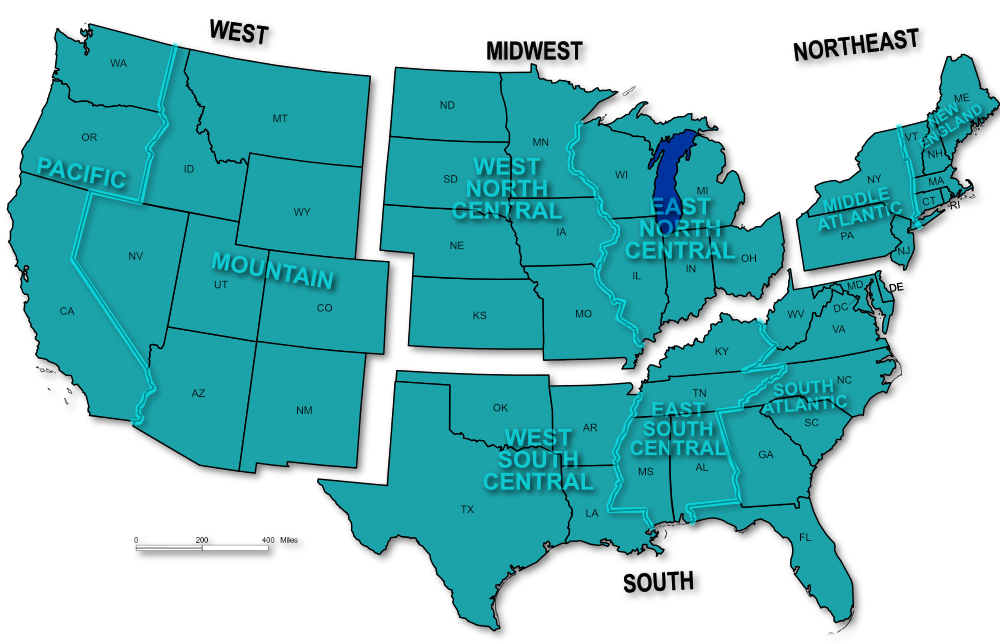

- Geographic regions identified for purchase

- Plans for business growth, opportunities for employees, operations and sales and marketing skills explained

Revenue range

Buyer acquisition target criteria range is companies with $7MM-$50MM in revenue.

The minimum EBITDA requirement is $1.5MM – $8MM.

Specific geographic interest

Highlighted in teal

Why choose us?

- You never pay money upfront

- We sell over 98% of businesses we list

- We’ve got a 25-year track record selling in the manufacturing sectors

- Consultations are always non-pressure, complimentary, and confidential