The state of the manufacturing M&A Market is Strong at the close of Q2 2021. The Market Pulse Report which tracks the M&A industry on a quarterly basis reported that Manufacturing and Engineering firms dominated sale activity in the lower middle market during Q2.

Here are some other findings from the report that manufacturers should pay attention to:

Top 5 Buyer Concerns

The top 5 buyer concerns for companies in the $2-$50 million range were as follows:

- Financial – Quality of Financial Reporting

- Revenues

- Management Team and Key Employees

- Employees – Longevity, Loyalty & Work Ethic

- Customer Concentration

For more information on how buyers view the value of a manufacturing company and where they see risks, check out my article: Business Valuation: What’s My Manufacturing Company Worth? In it, I discuss 15 factors that affect value.

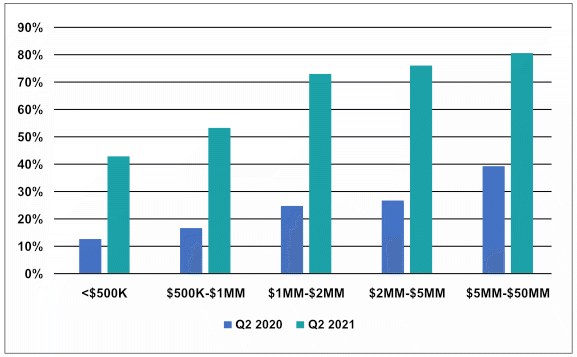

Seller Market Sentiment Year Over Year

Deal volume at the close of Q2 2021 is approaching near-record levels. It’s a Seller friendly market, as buyers are constrained by the low number of quality companies on the market. This shows in the year-over-year seller’s sentiment.

Where are Business Values Trending

In the $5-$50MM range, companies were selling at 100% of list price, with the average EBITDA multiple of 5.8x. This was up from 5.5x last quarter. It’s important to note that this includes all types of businesses. Manufacturing companies generally trade higher than other sectors. This is particularly true now as private equities seek pandemic proof investments. Manufacturing companies fit the bill, as they were deemed essential and remained open during the pandemic.

Cash at Closing

Buyers are in a strong cash position. Sellers are therefore enjoying 81-86% cash at closing. The balance is paid in seller financing and/or an earnout. Earnouts are being used to bridge a valuation gap when a company experienced a temporary COVID-related decline.

Who is Buying

Existing business owners dominated the M&A activity in Q2 with 44% and 43% of the $2-5 million and the $5-50 million price ranges. Just under 80% of the lower middle market buyers came from more than 100 miles away. The distance statistic has held true for the last few years. If you’re selling a manufacturing company, the best buyers are not local. If you’re thinking of selling, make sure your M&A professional works nationally.

The Manufacturing M&A Market is STRONG in Q2 2021. If you’d like to find out how buyers would view your manufacturing business and what it would likely sell for in today’s market, reach out to us for a no-cost, no-obligation consultation. With tax increases likely next year, there may never be a better time. Request a consultation HERE.